Cryptocurrency Tax Rate Nz

Cryptocurrency in New Zealand is not taxed in the same way as foreign currency investments. If your residual income tax RIT - tax on total income is more than 60k you should have already paid a third of your 2018 tax bill in August 2017 another third in January 2018 and the final third in May 2018.

3 Steps To Calculate Binance Taxes 2021 Updated

Income Head of Household.

Cryptocurrency tax rate nz. The amount of tax you pay depends on your total income for the tax year. Your specific tax rate primarily depends on three factors. As we know proof-of-stake is the blockchain validation system where users stake coins instead of mining them.

If you have not paid any tax yet your tax liability will be incurring IRD use of money interest UOMI at 822. New Zealand Inland Revenue has already published its thoughts on the taxation of cryptocurrency and has issued a discussion document on the treatment of cryptocurrency as a remuneration item. Instead bitcoin and other forms of digital currency is taxed in the same way as property.

Holders are then rewarded with staking rewards similar to dividends. Cryptocurrency generally operates independently of a central bank central authority or government. When a business receives cryptocurrency in payment for goods and services the business must find the value of the cryptocurrency in New Zealand dollars NZD at the time the business received it.

Note that this is the same as your ordinary income tax rate. Cryptoassets are treated as a form of property for tax purposes. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income.

A If you are a tax resident Taxed on worldwide income including cryptoasset income from overseas. While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the cryptoassets. 2020 Long-Term Capital Gains Tax Rates.

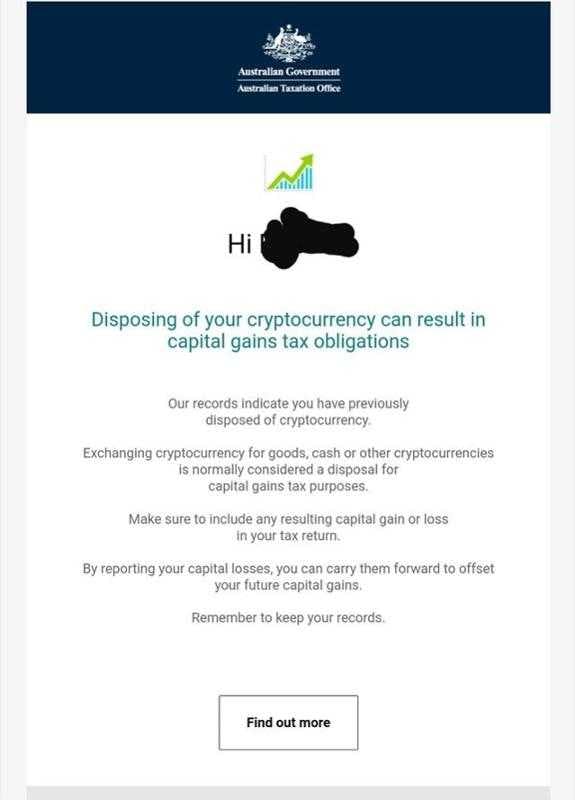

The creation trade and use of cryptocurrency is rapidly evolving. It does not depend on what they are called. Find out what you need to know about cryptoassets and your tax.

B If you are new or returning tax resident after 10 years Eligible for a 4-year temporary tax exemption on most types of foreign income. New Zealand bitcoin tax laws. If the exchange does not provide a NZD value for the cryptocurrency at the time of receipt the business must use a conversion rate from a reputable.

In Cryptocurrency Tax Entity Structure 1 Comment The Labour Party has announced that if re-elected they would introduce a new marginal tax rate of 39 for an individuals income over 180000. If you own bitcoin or are considering buying bitcoin it is important to understand what tax reporting obligations might apply. New Zealand has become the first country to legalize cryptocurrency salaries according to a report Monday from the Financial Times.

It is important therefore to understand the potential taxation implications when considering cryptocurrency as part of your strategy. These tax rates apply to short term capital gains crypto or other capital assets held for less than 1 year. Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz.

The 39 tax rate would only apply to income over 180000 and the remainder of an. Outlined below are the tax consequences for probably the m. We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand.

New Zealand has progressive or gradual tax rates. 02041224440 or timagbizaccountantsconz. In addition to that most new cryptocurrencies are now operating on proof-of-stake PoS rather than proof-of-work Pow.

Depending on how much money you make in. 1 The accounting method used for. Income Married Filing Jointly.

Contact us to ensure you are prepared for tax and have the right strategy in place. You can use CryptoTraderTax to automatically detect which cryptocurrencies in your portfolio qualify for long term capital gains and to help plan for future trades. If you are in the highest income tax bracket your taxes on your long term capital gains will be 20 instead of 37 the highest tax rate for short term gains.

The federal tax rate on cryptocurrency capital gains ranges from 0 to 37. This information is our current view of the income tax implications of common transactions involving cryptocurrency. Over 14000 and up to 48000.

The rates increase as your income increases. From 1 April 2021. With increased investment activity in bitcoin btc and cryptocurrency its important to consider any tax consequences that may arise.

If these situations apply feel free to give Tim a call or email. If you hold a crypto investment for at least one year before selling your gains qualify for the preferential long-term capital gains rate. For each dollar of income Tax rate.

Usually the returns are around 5-10 per year.

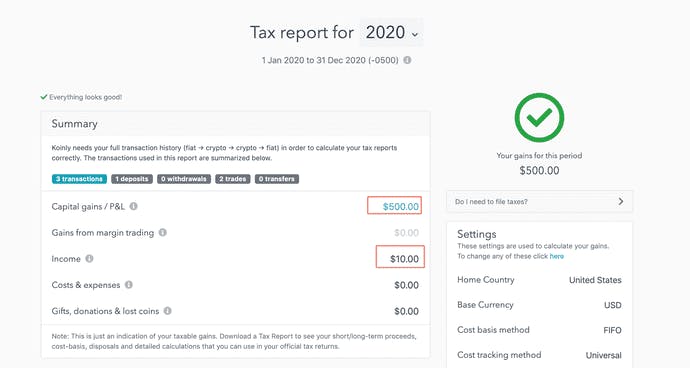

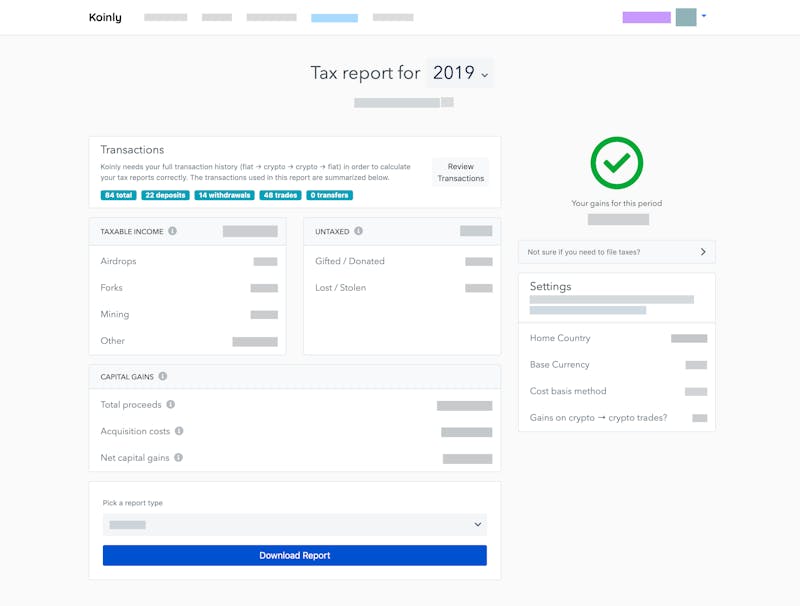

Koinly Crypto Tax Calculator For Australia Nz

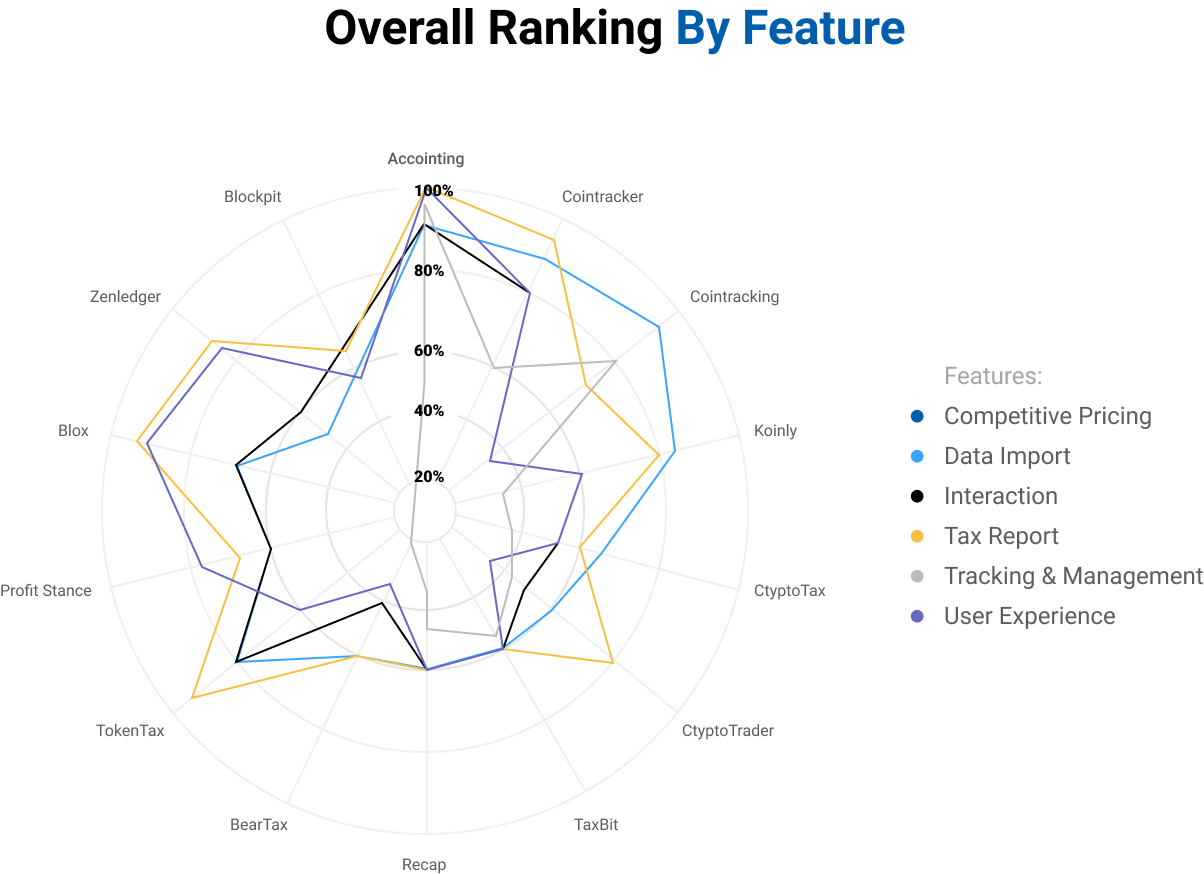

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship

Cryptocurrency Taxes In Australia The 2020 Guide Koinly

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Cryptocurrency Taxes In Australia The 2020 Guide Koinly

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship

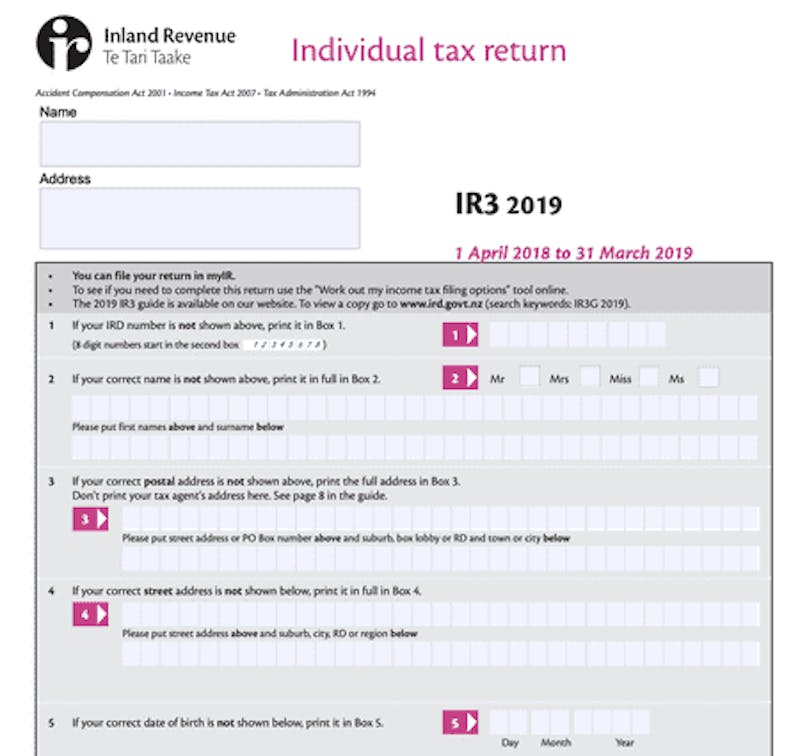

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Cryptocurrency Tax Guide 2021 Filing And Paying Taxes On Cryptos Bitira

Bitcoin Passive Income Online Earnmoneyonline Bitcoinpassive Extraincome Bitcoinpassive Cryptopassiveicome Passive Bitcoin How To Get

Best Crypto Tax Software 2021 Top 5 Bitcoin Tax Calculators Prevent Audits Coinmonks

Dot Flip Polkadot Overtakes Xrp To Become The Fourth Largest Cryptocurrency In 2021 Cryptocurrency Polka Dots Crypto Currencies

Tokentax Bitcoin Tax Tax Filing Software For Crypto Like Coinbase Tax Software Filing Taxes Cryptocurrency Trading

French Lawmakers Decreases Crypto Tax By 6 Percent To Read More Latest News Visit Https Coindelite Com Capital Gains Tax Cryptocurrency News Cryptocurrency

Best Crypto Tax Software 2021 Top 5 Bitcoin Tax Calculators Prevent Audits Coinmonks

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Cryptocurrency Tax Reports In Minutes Koinly

New Zealand Rules Receiving Income In Bitcoin Is Legal Taxable Nbsp Nbsp Bitcoin Nbsp Nbsp Nbsp Nbs Bitcoin Online Trading Investing

Post a Comment for "Cryptocurrency Tax Rate Nz"