Crypto Loans To Avoid Taxes

April 8 2019. By Ryan Chandler Brown.

How The Super Rich Avoid Paying Taxes Visual Ly Paying Taxes Tax Money Management

Some traders are using cryptocurrency as collateral to secure loans allowing them to keep their bitcoin and get cash while avoiding capital gains tax.

Crypto loans to avoid taxes. There is a rather simple strategy to avoid the personal tax implications of cryptocurrency trading and potentially avoid capital gains liability altogether. The IRS considers cryptocurrency to be property and as in traditional trading using your property as collateral for a loan is not considered a. The investor can therefore borrow USD against their crypto continue to HODL and pay less in interest than the taxes on the capital gains What are my tax liabilities when taking out a.

It looks like this post is about taxes. 5 mins read. As you can see when handled correctly cryptocurrency-backed loans do not result in any taxes.

Earn up to 12 APY on Bitcoin Ethereum USD EUR GBP Stablecoins more. Share on Facebook Share on Twitter. An expert on tax law told the WSJ the question would make it easier for the IRS to win cases if the taxpayer checks the no box and is later found to have held crypto.

There are plenty of questions about whether or not investors can claim a direct crypto conversion eg. Getting a fiat loan on your appreciated crypto is a great way to withdraw money without paying capital gains tax. If a crypto loan is managed properly and all parties uphold the terms of the loan the parties should not incur any taxes.

With that said the IRS could technically argue that cryptocurrency loans are taxable. Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about. How some traders avoid bitcoin taxes using crypto loans Some traders are using cryptocurrency as collateral to secure loans allowing them to keep their bitcoin and get cash while avoiding capital gains tax.

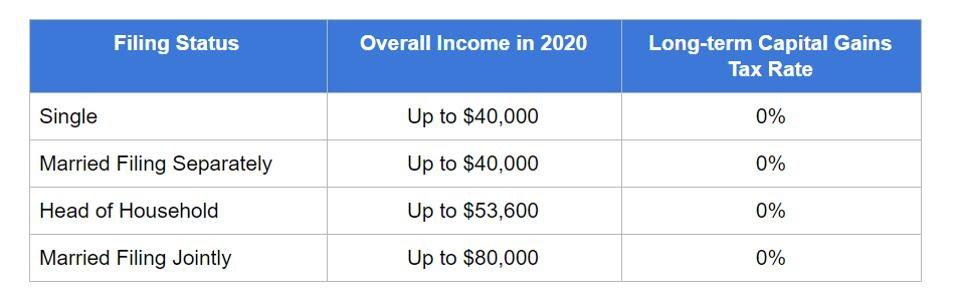

The Legal Way To Avoid Crypto Taxes and Reporting. For any significant cryptocurrency gains that you plan to realize you should see if you have the ability to lock in long term capital gains rates. Aug 16 2019 at 0712 am.

Do not endorse suggest advocate instruct others or ask for help with tax evasion. They use crypto to secure loans which allow them to keep their respective bitcoin. The IRS Internal Revenue Services classify cryptocurrency as a capital asset and recently some clever people have found out a way to the loopholes in existing laws to avoid paying tax using crypto 100 percent legally.

In turn they get cash because of which they can avoid the taxes. Remember long term capital gains apply for crypto that is held for longer than 1 year and they offer significantly lower tax rates when compared to short term gains. Traders use cryptocurrency as a collateral to avoid capital gain taxes.

Bitcoin to ethereum as like-kind avoiding taxes on those transactions. How Are Crypto Loans Taxed. The tax laws changed beginning in 2018 and like-kind exchanges are only applicable to real estate transactions.

How to Legally Avoid Crypto Taxes. As mentioned above the IRS considers cryptos as being capital assets. The crypto loan industry is flourishing with each day because of the option to use crypto loans.

One of the easiest ways to bypass the tax requirements on your cryptocurrencies is to buy inside of an IRA 401-k or any other retirement plan of the sorts. Cryptocurrency coins with exchange rate table various crypto money on business office dek. This is a site wide rule and a subreddit rule.

This article will analyze several transactions associated with a cryptocurrency loan and understand their tax implications. Well borrowing against crypto assets is NOT a sale thus no tax is due on the transaction. Please note that Rule 4 does not allow for Tax Evasion.

Tax loopholes are interesting gaps in the IRS code which you can use to reduce your taxes legallyThis post discusses an important crypto tax loophole which could significantly reduce your crypto.

How To Avoid Crypto Taxes Cashing Out Youtube

Blockfi Helps Crypto Investors Manage Digital Assets And Earn Crypto By Offering Crypto Interest A Paying Off Credit Cards Wealth Management Business Expansion

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Tax Payment

The Accounting And Tax In Canada Personal Financial Planning Financial Financial Education

6 Ways To Eliminate Reduce Your Crypto Tax Rate

How To Transfer Bitcoin Without Triggering Taxes In 2021 Bitcoin Paying Taxes Blockchain

10 Tax Filing Mistakes To Avoid Filing Taxes Mistakes Smart Money

How Business Owners Can Avoid Double Taxation Smartasset Business Tax Financial Advisors Income Tax

Don T Wait Any Longer File Your Taxes Now With Eztaxreturn Tax Taxes Tax Software Filing Taxes Tips

Credit Mistakes To Avoid Make More Money Payday Loans Credits

Tax Guidance On Virtual Currency Cryptocurrency Transactions Virtual Currency Tax Rules Paying Taxes

At A Glance The Risks Of Popular Defi Liquidity Mining Impermanent Losses Transaction Fees Smart Contracts Etc Gas Prices Contract Risk

7 Best Bitcoin Payment Gateways To Accept Crypto For Your Business Thinkmaverick My Personal Journey Through Entrepreneurship Video Video Bitcoin Ecommerce Startup Bitcoin Transaction

How Can I Avoid Paying Taxes On Bitcoin And Crypto 100 Legal Youtube

Pensions And Perks For Former Presidents Foundation National Taxpayers Union In 2021 Income Tax Income Tax Return Filing Taxes

Avoid Paying Taxes On Cryptocurrency Legally Youtube

How Do Crypto Taxes Work A Simple Guide With Infographics

Form 1099 C And How To Avoid Taxes On Canceled Debt Qwest Credit Enhancement Blog Debt Income Tax Income Tax Return

Post a Comment for "Crypto Loans To Avoid Taxes"